Supercharge Your Japanese Investments!

Get ahead in the Japanese market with our exclusive daily newsletter. Uncover local news missed by mainstream sources like Bloomberg, meticulously translated into English. We focus on Games, Internet, SaaS and overall Japan sectors, with expanding coverage.

Save over 3 hours daily – we do the research for you! Receive key insights, including unique data like real-time credit-card spending, offering a live pulse of the Japanese economy.

Subscribe now for just US$100/month! Daily emails sent after Japan market closes or through Bloomberg/FactSet. Elevate your investments with our concise, timely, and invaluable updates!

This is a free sample, with subscriptions close 1st Feb so act now.

Here are the most interesting local Japan news items from 25 Jan 2024. If you do not want to receive this please let me know or adjust preferences at link at bottom. Stocks mentioned:- SoftBank Group, Sansan, CyberAgent, LY Corp., BASE, Square Enix, Bandai Namco, Sega Sammy.

Detail

INTERNET

TravelPerk Secures over $100m in Funding Led by SoftBank VF2 to Expand Hyper-Growth Business Travel Platform

TravelPerk, the hyper-growth business travel management platform, announced it has closed an additional $104m investment led by SoftBank Vision Fund 2 with significant participation from existing investors, including Kinnevik and Felix Capital. The round is an extension of the Series D-1 raised in January 2022, led by General Catalyst. Stephen Thorne, Investment Director for SoftBank Investment Advisers will join the TravelPerk Board of Directors. Source: TravelPerk

SoftBank Group: Non-consolidated gain of ¥1.26Trn from settlement of BABA forward contracts but no impact on consolidated

SBG will record a gain on sale of investment securities of JPY 1.26tn as extraordinary income in its non-consolidated financial results for FY3/2024, as a result of the settlement of certain intra-group transactions between SBG and Skybridge, a wholly owned subsidiary, related to the prepaid forward contracts using shares of Alibaba. Impact on financial results,” no gain on sale of investment securities will be recognized in SBG’s consolidated financial results. Source: SBG

CyberAgent: ABEMA Launches Global Online Live Platform "ABEMA Live"

ABEMA is set to introduce "ABEMA Live," an online live platform catering to a global audience, enabling viewers from overseas to enjoy Asian entertainment, including Japan. The service will initially launch in three countries—Thailand, the Philippines, and South Korea—with plans for a gradual expansion of the service area. Source: CyberAgent

Current Status of PayPay's India Office

Interview with Mr. Munenori Hirakawa, Managing Director of Pay2 Development Center. When the office was established in January 2023, there were four members, but it has since expanded to encompass multiple teams. PayPay is built on a microservices architecture, so collaboration is necessary when the Japanese team interacts with the managed microservices. However, over time, there has been an increase in tasks that the Indian team can handle independently. Source: PayPay

Limits of Direct Recruiting

An individual working at One Capital, in a post related to X, pointed out the limitations of direct recruiting. He mentioned, "In media such as BizReach, Recruit Direct Scout, AMBI, and others, recruiters focus on what candidates can do rather than their willingness. As a result, those who wish to make a career change may never receive a scout forever." Source: X

Payroll Announces MBO

Payroll has announced its intention to undergo a MBO. The American investment firm TA Associates will conduct with an expected total acquisition amount of about JPY 24bn. Payroll primarily engages in salary calculation services and outsourcing for major corporations. The company went public in June 2021. In an industry marked by intense competition, encompassing service capabilities and pricing, Payroll aims to secure operational flexibility and introduce external expertise to foster business development. The decision to undergo a MBO is driven by the desire to navigate and thrive amid the heightened competitive landscape. Source: Payroll

Reports of Phishing Attempts Posing as Mercari on the Rise

The Council of Anti-Phishing Japan has issued a cautionary notice as there has been an increase in reports of phishing attempts impersonating Mercari. Source: Council of Anti-phishing Japan

Paidy Signs Official Partnership Agreement with Basketball Club

Paidy has entered into an official partnership agreement as the official partner for the 2023-2024 season with Sunrockers Shibuya, a professional basketball team in the basketball league. It's worth noting that the available payment methods for purchasing game tickets include credit cards, convenience stores, and PayPay exclusively so far. Source: Paidy

Persol: Usage of Generated AI in New Graduate Recruitment at Companies

A survey was conducted in December 2023, examining 176 companies utilizing the doda platform. Here are the findings:-In the realm of tasks related to new graduate recruitment, 11.4% of companies are employing generated AI tools such as ChatGPT-Regarding students utilizing generated AI, 6.3% believe it should be actively used, while 64.2% consider it acceptable for students to use it as needed-Companies find it desirable for students to use generated AI in specific scenarios during job hunting, with industry and job type research ranking first at 26.2%, followed by company analysis at 22.5%-When asked about the potential impact of increased usage of generated AI on recruitment requirements, 54.5% responded that they are unsure of the changes that may occur.Source: Persol

SAAS

Sansan: Bill One Collaborates with Dream Arts' SmartDB

Bill One, Sansan's invoice management service, and Dream Arts' business digitalization cloud service, SmartDB, tailored for large enterprises, are now integrated. SmartDB serves as a no-code development platform equipped with workflow and web database functionalities, enabling complete digitalization of business processes with a focus on on-site operations. When invoices are received via Bill One, the system accurately digitizes the invoice information and automatically determines whether it meets the criteria for valid invoices. The invoice details are then integrated into SmartDB through APIs, triggering internal approvals necessary for payment. Upon approval, the information is synchronized with core systems. This collaboration streamlines complex invoice processes for large enterprises, ensuring compliance with legal requirements and accelerating the monthly closing process. Source: Sansan

Survey on Sansan's Invoice System Compliance

A survey was conducted in January with 1,000 individuals involved in invoice-related tasks. Here are the findings: - 66.4% can handle the invoice system without any issues

- Among companies facing challenges in compliance, the accounting department experiences an increase of 8.5 hours per person per month, while non-accounting roles see an increase of 9.0 hours per person per month

- Companies successfully handling the system are actively engaged in "Explanation and Awareness to Employees" and "Digitization of Accounting Tasks."

- The benefits of digitizing accounting tasks include improved productivity and a reduction in paper costs.

Source: Sansan

BASE Launches Overseas Sales Agency App

BASE has introduced a feature that allows outsourcing all tasks, including shipping and inquiry responses, to domestic agency partners after receiving orders from overseas. This functionality facilitates easy implementation of cross-border EC to over 190 countries. The service is available for a monthly fee of 980 yen, and the first 90 days are free. According to a survey conducted by BASE in October 2023, 56.1% of respondents expressed interest in cross-border EC but indicated that they had not yet engaged in it. Source BASE

GAMES

Switch Japan game sales 196,000 (-44.0% yoy) last week

"Marvel’s Spider-Man 2" secured the top spot by selling 30,000 units, partially due to a sale on bundled versions. In terms of new releases, "Another Code: Recollection" entered at 4th place with sales of 16,000 units. While this falls short of the 48,000 units sold in the first week by "Another Code: Two Memories," released for the DS in February 2005, it did surpass the first-week sales of 10,000 units for "Another Code: R – A Journey into Lost Memories," released for the Wii in February 2009. The hardware market remained weak with a total of 44,000 Switch consoles sold for the three models (-15.3% yoy). During the same period, the PS5 sold 58,000 (+ 37.4% yoy) and the Xbox sold 2,000 (+ 99.8% yoy). Nintendo's new title "Another Code: Recollection" entered at 4th place with sales of 16,000 units. Source: Famitsu

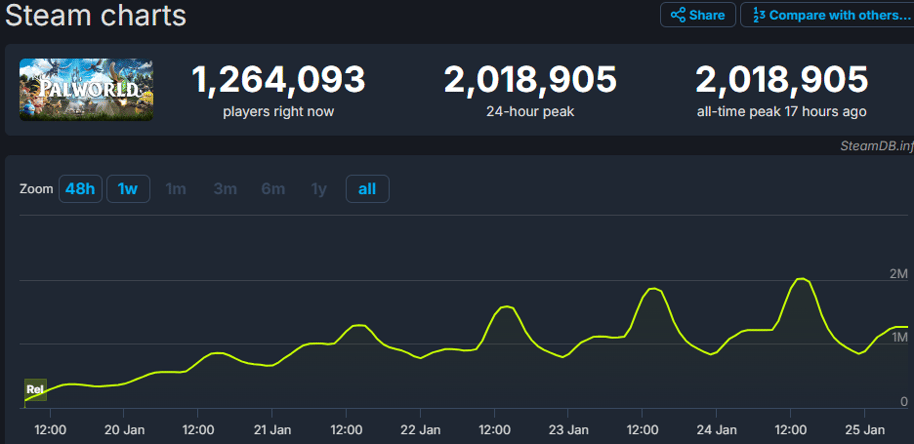

Japanese developer Pocket Pair behind Palworld hit that is "Pokémon with guns"

Unlisted and private Pocket Paid is a Japanese indie developer which has released Palworld on PC/Xbox and has sold 8m copies at US$40 over just 6 days. On steam the peak CCU passed 2m, the 2nd highest ever behind PUBG which hit 3m over six years ago. The game has been called "Pokémon with guns", which caused the Pokémon Company today to say "We intend to investigate and take appropriate measures to address any acts that infringe on intellectual property rights related to the Pokémon". One IP lawyer thinks the company has little to worry about. Pocket Paid has been making games since 2015 with some success but its latest title is an interaction of previous titles with a new approx. It cost approx. US$7m to make by 40 people but has earned US$320m so far and is growing at US$40m per day!. Source: X, Japan Times, Insider-Gaming

Source: SteamDB.

Positive reviews for Like a Dragon: Infinite Wealth and Tekken 8

Like a Dragon: Infinite Wealth launches January 26, 2024 for PlayStation 5, PlayStation 4, Xbox Series, Xbox One and PC. Reviews so far are 9/10 or higher, which is a good sign for Sega Sammy. Tekken 8 will come out on January 26, 2024 for the PS5, Xbox Series X/S, and Windows PC. Reviews are 9/10 or higher and should help sales for Bandai Namco. Source: Famitsu.

Top ranked games stories on Famitsu

1. Pokémon Company has released a commend regarding similar games from other companies

2. Ryu ga Gotoku 8 review from a man who played for 80hrs

3. Live production of FF14 confirmed cancelled - too large a project, Amazon came close.

4. One Piece special room light goes on sale Feb 23rd.

5. Splatoon 3 DLC to be released Feb 22nd.

Source: Famitsu

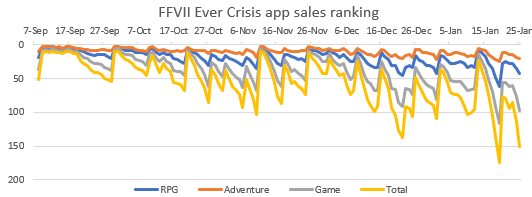

Square Enix: FINAL FANTASY VII EVER CRISIS iPhone app sales ranking in Japan on iOS

Source: Applion

JAPAN

What are retail most interested in today?

Rakuten Securities top 5 most popular articles today

1. Possibility of BOJ's Negative Interest Rate Policy Reversal Emerging in March

2. Lawyers' Carefully Selected "Top 10 Stocks to Hold in 2024"

3. High Dividend Stock Rankings

4. Should You Quickly Utilize the New NISA Tax-Free Investment Limit of 18 Million Yen?

5. J-REIT Investment in the New NISA! Average Distribution Yield at 4.3%

Source: Rakuten

52-Week Highs:100 total; due to the volume, we are only displaying those with market cap >$10.0B

o 1662.JP (Japan Petroleum Exploration Co. ¥6070.00, +120.00) +2.0%; 52-week +52.2%

o 4631.JP (DIC ¥2829.50, +134.50) +5.0%; 52-week +22.8%

o 5711.JP (Mitsubishi Materials ¥2676.50, +57.50) +2.2%; 52-week +23.5%

o 5741.JP (UACJ Corp ¥4065.00, +15.00) +0.4%; 52-week +68.9%

o 6315.JP (Towa Corp ¥7860.00, +570.00) +7.8%; 52-week +298.7%

o 6361.JP (Ebara Corp ¥9392.00, +162.00) +1.8%; 52-week +74.5%

o 6371.JP (Tsubakimoto Chain ¥4220.00, +35.00) +0.8%; 52-week +42.6%

o 6417.JP (Sankyo Co. ¥9226.00, -9.00) -0.1%; 52-week +84.8%

o 6504.JP (Fuji Electric Co. ¥7377.00, +176.00) +2.4%; 52-week +41.2%

o 6622.JP (Daihen ¥6940.00, +130.00) +1.9%; 52-week +72.8%

o 6728.JP (ULVAC, Inc. ¥7372.00, +227.00) +3.2%; 52-week +23.6%

o 6871.JP (Micronics Japan Co. ¥4240.00, +45.00) +1.1%; 52-week +201.2%

o 6951.JP (JEOL Ltd ¥7260.00, +432.00) +6.3%; 52-week +91.9%

o 7182.JP (Japan Post Bank ¥1549.00, -9.50) -0.6%; 52-week +41.9%

o 7735.JP (SCREEN ¥14755.00, +155.00) +1.1%; 52-week +217.7%

o 7966.JP (LINTEC ¥2812.00, +68.00) +2.5%; 52-week +33.7%

o 8304.JP (Aozora Bank ¥3264.00, -12.00) -0.4%; 52-week +31.6%

o 8306.JP (Mitsubishi UFJ Financial ¥1383.50, -0.50) 0.0%; 52-week +48.9%

o 8584.JP (JACCS Co. ¥5810.00, +110.00) +1.9%; 52-week +47.7%

o 8601.JP (Daiwa Securities ¥1073.00, +35.00) +3.4%; 52-week +84.5%

o 8604.JP (Nomura ¥762.40, +21.70) +2.9%; 52-week +53.0%

o 8609.JP (Okasan Securities Group ¥762.00, +19.00) +2.6%; 52-week +86.3%

o 8766.JP (Tokio Marine Holdings ¥3845.00, -3.00) -0.1%; 52-week +43.8%

o 9787.JP (AEON DELIGHT CO. ¥3735.00, +60.00) +1.6%; 52-week +25.3%

o 9843.JP (Nitori Holdings ¥19275.00, +130.00) +0.7%; 52-week +14.0%

52-Week Lows: 6 total

o 1377.JP (Sakata Seed ¥3690.00, +5.00) +0.1%; 52-week -7.6%

o 3577.JP (Tokai Senko KK ¥861.00, +7.00) +0.8%; 52-week -21.8%

o 4985.JP (Earth Corp ¥4430.00, -25.00) -0.6%; 52-week -9.1%

o 5726.JP (OSAKA Titanium Technologies Co. ¥2565.00, -56.00) -2.1%; 52-week -33.6%

o 6474.JP (Nachi-Fujikoshi ¥3460.00, -35.00) -1.0%; 52-week -5.2%

o 8107.JP (KIMURATAN ¥18.00, -0.00) 0.0%; 52-week -18.2%

Source: FactSet

Translation errors can occur, so please be careful. Treat this information as news and not research. If you know others who would be interested to receive this or you do not want to receive it, please let me know.

Gibbo.

David Gibson CFA

Senior Research Analyst

david.gibson@mstfinancial.com.au